The Government have announced their Autumn Budget 2025, and there are changes being made which will impact employers of household staff in the UK.

1. 4.1% increase to the National Living Wage

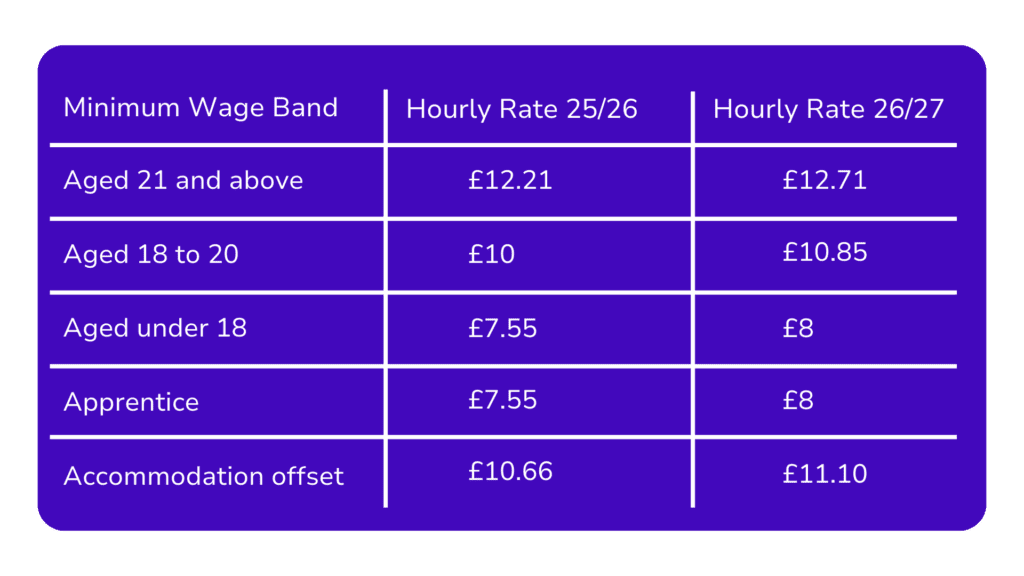

The National Living Wage will increase by 4.1%, from £12.21 to £12.71 per hour, in April 2026.

If your employee lives with you and you are operating the accommodation allowance, the accommodation offset rate will increase by 4.1% to £11.10 per day.

As a domestic staff employer, you must ensure you are paying your employee(s) in line with the latest rates for the National Living Wage and the National Minimum Wage.

If you are a Stafftax customer and would like to check that your employee’s salary will still meet the National Living Wage and the National Minimum Wage in April 2026, please contact our dedicated team.

2. Tax and National Insurance freeze extended

The freeze on tax and National Insurance has been extended until 2030 – 2031.

The amount of Income Tax you deduct from your employee depends on their tax code and how much of their taxable income is above their Personal allowance. Your employee’s personal tax free allowance is frozen at the limit of £12,570. This means they will continue to pay income tax on any earnings which are above the £12,570 threshold.

3. Salary Sacrifice on Pension Contributions from April 2029

National Insurance relief on salary sacrifice pension contributions will be capped at £2,000 from April 2029. This means that any contributions above £2,000 will be subject to National Insurance payments by both the employee and the employer.