Rates & Thresholds for Domestic Staff Employers 2023/2024

As the new tax year approaches it’s important that all domestic staff employers are aware of the changes that will come into effect on the 6th of April 2023. We’ve covered all the major changes that might impact you and your household staff below, but full details of the new Tax Rates & Thresholds can be found here.

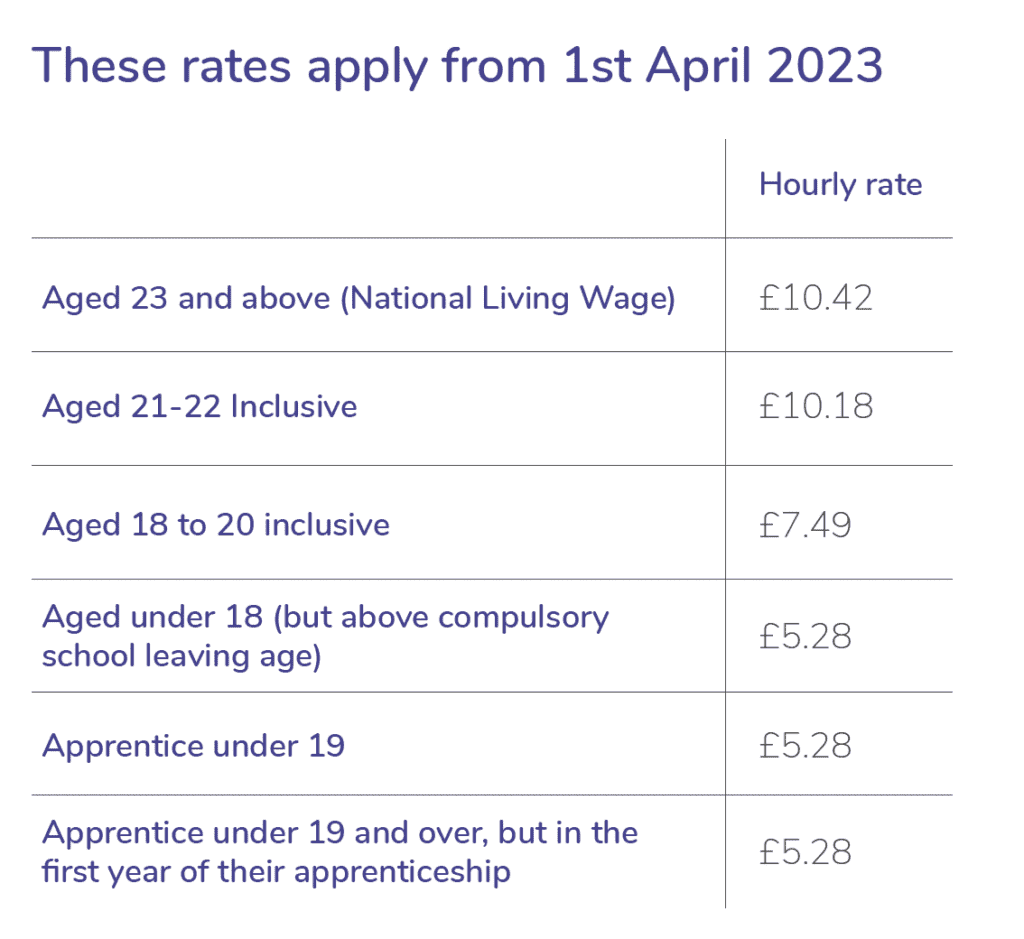

The National Minimum Wage & The National Living Wage

The National Minimum Wage and National Living Wage have increased and as an Employer, you have a legal obligation to be compliant. You can see all the changes in the table below.

This applies from 1st April 2023.

If you need to make adjustments to your household staff’s salary, you can do so via our Members Area or by calling our team!

Statutory Payment rates for 2023/2024

For Statutory Maternity Pay (SMP) and Statutory Adoption Pay (SAP), the rates remain the same for the first six weeks – at 90% of your domestic staff’s average weekly earnings (AWE). The statutory weekly rate for the remaining 33 weeks, will increase from April 2023. This increase will be £172.48 or 90% of your domestic staff’s average weekly earnings, whichever is lower.

Statutory Paternity Pay (SPP), Statutory Shared Parental Pay (ShPP) and Statutory Parental Bereavement Pay (SPBP) will all share the same weekly rate of £172.48 or 90% of your domestic staff’s average weekly earnings, whichever is lower.

From the 10th of April 2023, the weekly rate for Statutory Sick Pay (SSP) will increase from £99.35 to £109.40.

These changes will apply from April 2023.

National Insurance & Tax-Free Allowance

National insurance contributions will remain the same as 2022-2023 and personal tax-free allowance has been frozen at last year’s limit of £12,570 per year. This means the standard tax code will also remain the same at 1257L.

The amount of Income Tax you deduct from your household staff’s salary depends on their tax code and how much of their taxable income is above their personal allowance.

You’ll only pay income tax on any earnings which are above the £12,570 threshold.

Live-In Household Staff

If your staff lives with you and you manage the accommodation allowance, you must ensure your household staff is/are being paid in line with the latest National Minimum Wage or above.

If you need to adjust your staff’s salary, you can do this via our Members Area or by calling our team.

Benefits in Kind

As part of your subscription fee, we will complete a submission to HMRC for any taxable benefits you are providing your nanny with. The deadline to declare all the necessary Benefits in Kind information to us is the 31st March 2023. All you need to do is let us know what your household staff’s benefits are, and we will submit the P11D on your behalf.

If you have any questions about any of these changes you can email us at info@stafftax.co.uk or call us on 020 3137 4407, and we’ll be happy to help!